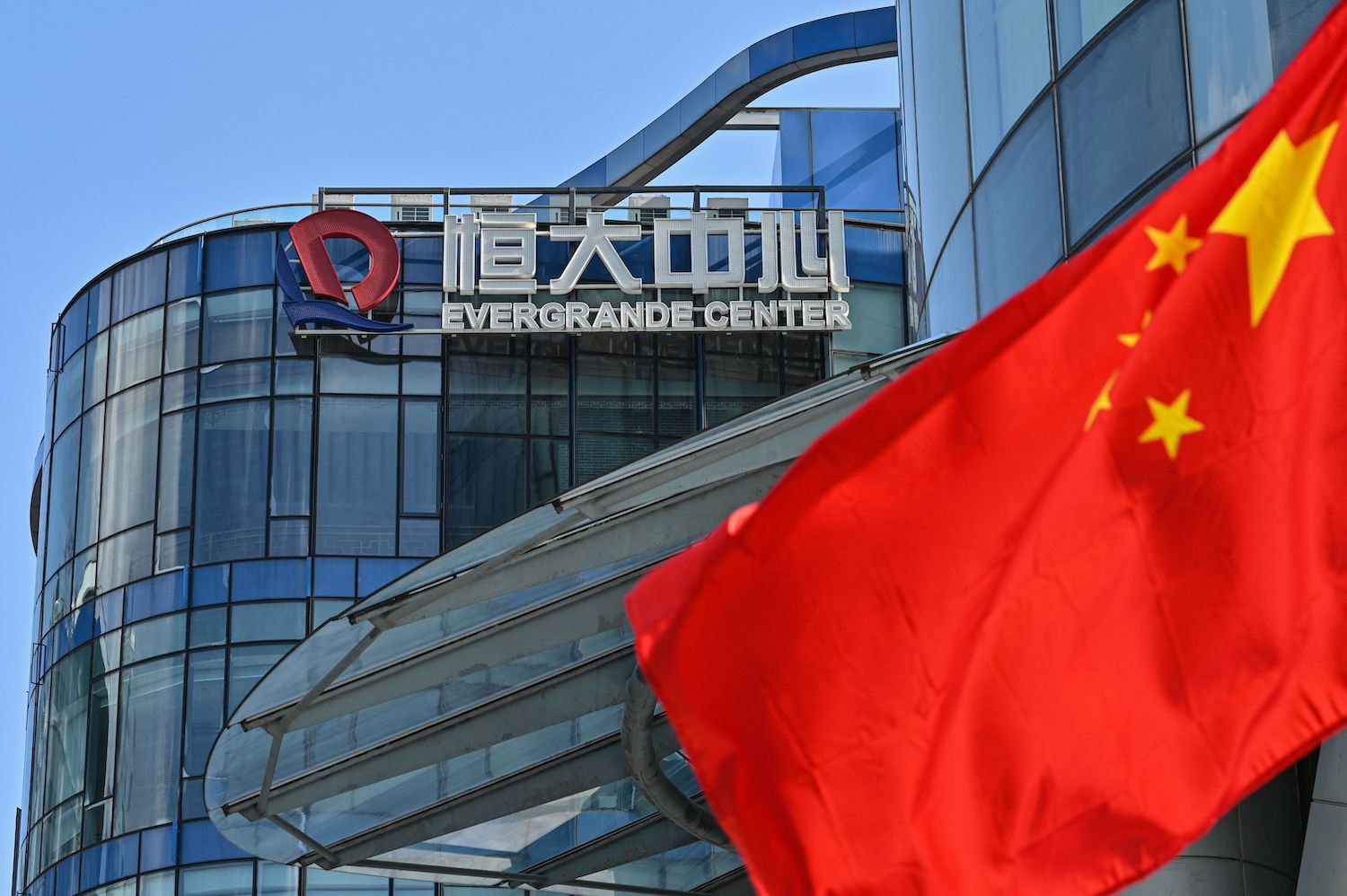

China's second largest developer Evergrande in trouble

Published by: 10.11.2021 16:30:43

Evergrande is China's second-largest developer by sales volume. It has nearly 200,000 employees and nearly 4 million people are connected to the company through employment. More than 70 thousand investors hold the company's debt securities, including several hundred banks (including European ones) and other financial institutions. Evergrande has between 1 and 1.5 million shares under construction. Evergrande has 1.5 million apartments and is managing 2,800 neighbourhoods in more than 300 cities. In addition, the company has businesses in the healthcare, consumer goods, entertainment and also electric vehicles sectors.

Evergrande's problems are linked to the easy availability of cheap credit in China. Because of this, people widely speculate in the real estate market. Buying real estate for the purpose of investment is widespread. The company is heavily indebted and "leveraged," but recent moves by the Chinese administration have severely limited the opportunities to roll over debt - paying off old debt and then taking on new debt.

The company's debt slightly exceeds $300 billion. However, loans and bonds are worth only a quarter of that amount. The rest is made up of obligations to suppliers and construction contractors. Bonds issued abroad (outside China) amount to $20 billion. Foreign debt is relatively small, but the important information is that Evergrande is one of the largest issuers of corporate bonds in emerging markets. The potential collapse of Evergrande creates a significant risk of bankruptcy for other highly indebted companies. According to Fitch, Evergrande must pay a total of $129m in interest on loans in September alone, and by the end of the year Evergrande must take care of $850m in bond coupons. The company then faces a $7.4 billion bond payment next year.

Regulators have warned for some time that the company is not doing well and have pushed for a modest reduction in overall debt. A collapse could lead to significant problems for China's banking sector and could trigger a wave of crashes in China's real estate sector. On the other hand, there is no suggestion that the Chinese administration can prevent the crisis. There is speculation that government aid could be given to banks and residents rather than real estate companies. But much of the market fears that a state-controlled bankruptcy could spiral out of control and cause a liquidity crisis.

Documents to download

K&L Rock also declares that it is not liable for any direct or indirect damage resulting from trading on the capital markets in general, and posts in discussions expressing the views of readers may not be in line with the operator's position and therefore cannot be regarded as its views.